1

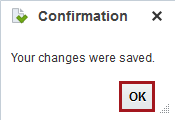

2

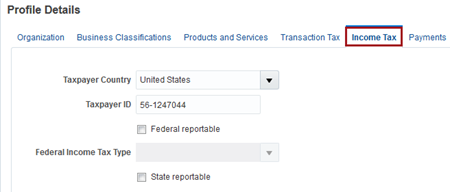

*Note: If the Taxpayer Country and Taxpayer ID fields are not set, then do so now.

3

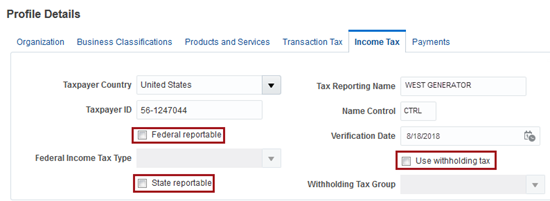

Complete the following Income Tax fields, if required:

Enable the Federal reportable check box (this enables the Federal Income Tax Type field)

Set the Federal Income Tax Type (For a list of income tax types, see Federal Income Tax Types)

Click the State reportable check box

Enter the Tax Reporting Name (as provided in the 1099 form)

Enter the Name Control

Enter the Verification Date

Enable the Use withholding tax check box (this enables the Withholding Tax Group field)

Enter the Withholding Tax Group

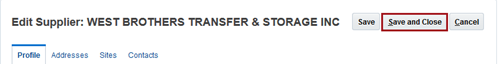

4

5